Top 10 Singapore Retirement Planning Calculators

Planning your retirement requires specific financial tools to reach all your intended objectives. In Singapore, several online Singapore retirement planning calculators are available to guide individuals in estimating their retirement needs and determining how much they need to save. Here’s a list of the top 10 retirement planning tools in Singapore to help you with your retirement planning process.

1. Standard Chartered Retirement Planning Calculator

Link: Standard Chartered Retirement Planning Calculator

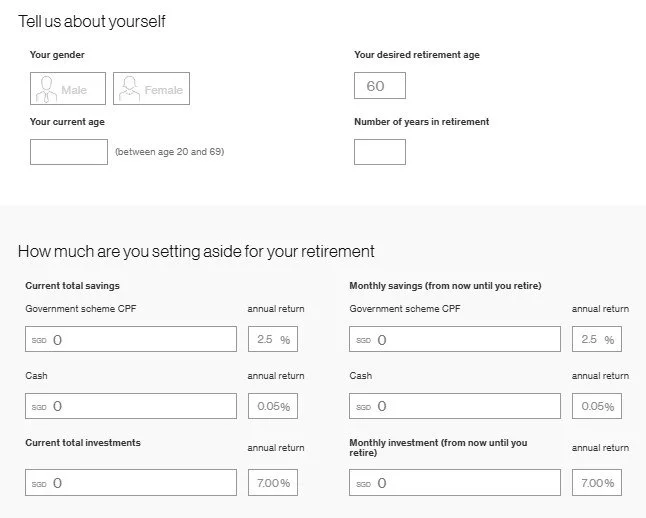

Standard Chartered provides a basic retirement calculator that shows users how much to set aside each month to achieve retirement targets. The system uses your existing money plus regular investments toward retirement to give you an approximate outcome.

2. Great Eastern Life Retirement Income Calculator

Link: Great Eastern Life Retirement Income Calculator

Great Eastern Life creates a tool that shows how much retirement income you want and helps you test whether your savings are enough. It also considers retirement income Singapore and different financial planning stages, making it ideal for those seeking to maximize their savings for retirement.

3. PlannerBee Retirement Calculator

Link: PlannerBee Retirement Calculator

PlannerBee offers a user-friendly retirement planning software that allows users to assess their retirement goals based on their current income and projected expenses. The tool produces dependable results about how much money you should put away for retirement living.

4. DBS Retirement Calculator

Link: DBS Retirement Calculator

DBS provides a saving calculator to show you exactly what you must store up for your retirement years. You need to enter your existing account balance along with your yearly profits and lifestyle choices. Users can easily see their savings requirements annually by using this tool to reach financial independence in Asia.

5. St. James’s Place Retirement Planning Tool

Link: St. James’s Place Retirement Planning

St. James’s Place offers an effective tool that determines the funds necessary to achieve retirement security. The tool also offers insights into how much your CPF will contribute to your retirement income statistics and how to supplement it with other financial products.

6. Autumn Retirement Calculator

Link: Autumn Retirement Calculator

Autumn’s calculator simplifies the Singapore retirement planning process by factoring in inflation, life expectancy, and current savings. Users can find out their monthly savings target plus they can modify retirement plans via this tool.

7. Shubhangipai Retirement Planning Calculator

Link: Shubhangipai Retirement Calculator

This retirement planning calculator allows you to project your retirement savings and income needs based on your desired lifestyle. Starting retirement planning in Singapore is best with this tool because it makes it simple to use and shows short-term and long-term retirement results effectively.

8. The Simple Sum Retirement Calculator

Link: The Simple Sum Retirement Calculator

The Simple Sum calculator allows you to prepare for retirement effectively by managing lifestyle demands with current savings. It provides a realistic approach to Singapore retirement planning and ensures that your retirement income plan is aligned with your goals.

9. Syfe Retirement Calculator

Link: Syfe Retirement Calculator

Syfe helps you develop an advanced retirement income plan through their calculator by choosing how to invest in stocks bonds and REITs. People searching for advanced retirement investment approaches will find this tool very useful.

10. CPF Retirement Income Planner

Link: CPF Retirement Income Planner

The official CPF Retirement Income Planner allows users to predict their retirement earnings from CPF LIFE distributions and their other CPF accounts. It provides a comprehensive view of your retirement income Singapore and ensures that you’re on track to meet your financial needs during retirement.

Conclusion: Plan for Your Future with the Right Tools

Retirement planning can be complex, but with the right retirement planning tools, you can make well-informed decisions about your future. Whether you're just beginning your retirement journey or adjusting your plans for an early retirement, the Singapore retirement planning calculators can provide the insights you need to ensure a financially secure retirement.

At Ascendant Globalcredit Group, we offer tailored financial solutions to help you bridge any Singapore retirement planning savings gap and achieve financial independence in Asia. Ready to plan your retirement with confidence? Book a Consultation Now and take the first step toward a secure retirement.

FAQs About Retirement Planning in Singapore

-

People need $2,500 to $4,000 each month to retire properly in Singapore depending on their lifestyle and accommodation choices. It's essential to use a Singapore retirement planning calculator to assess your exact needs.

-

To plan your retirement you should analyze your present savings combined with your income needs during retirement. Use the suggested retirement calculators to receive estimated results.

-

Your $600,000 retirement savings will provide enough income for your requested lifestyle depending on your desired retirement needs. Individuals need different amounts to maintain a relaxed retirement since basic costs do not meet all future needs.

-

The lifetime of $500,000 depends on your budget and investment profits. When taking a 4% yearly withdrawal from $500,000 you will receive enough funds to sustain your lifestyle for 20 to 25 years. A retirement income calculator gives you an exact result by looking at your numbers.